Follow the discussion on LinkedIn

At Field Ventures, we've built our investment thesis around a fundamental belief: the most transformative businesses emerge when domain experts apply innovative technology to modernize antiquated industries. Today, we are in the very early innings of a significant paradigm shift in enterprise software, the transition from Software-as-a-Service to Service-as-a-Software. This isn’t just a change in how software is delivered; it’s a change in what software is expected to do.

Software is no longer a tool. It’s becoming a teammate.

The Fundamental Shift: From Tools to Workers

The traditional Software-as-a-Service model has served us well for over two decades, enabling organizations to digitize workflows, boost productivity, and create new revenue streams. However, SaaS has inherent limitations that become particularly apparent when attempting to penetrate traditional markets. Traditional software acts as a tool that assists humans with workflows, requiring significant manual input and configuration to achieve desired outcomes. Software-as-a-Service (SaaS) traditionally provides customers with a tool or platform, but the customer is responsible for utilizing it to achieve desired outcomes. For example, Salesforce helps manage leads, but your sales reps still do the selling. In a services business, by contrast, the provider delivers an outcome for the customer (e.g., an accounting firm preparing your taxes for you).

Whereas, Service-as-a-Software represents a fundamental reimagining of this relationship. Service-as-Software flips SaaS on its head by having the software itself deliver the outcome, blurring the line between software product and service provider. Instead of providing software that helps users complete tasks, Service-as-a-Software delivers autonomous AI agents that actually perform the work itself. In other words, the software becomes the worker. Instead of just a tool, you’re buying an “employee” that can execute tasks autonomously. This isn't merely an incremental improvement. It's a complete transformation from software that organizes human work to software that becomes the worker.

The Evolution from Systems of Record to Systems of Work

Over the past several decades, enterprise software has undergone a profound transformation, mirroring the broader digitization and automation of business processes. At Field, we view this evolution as a multi-stage journey, with each phase unlocking new value for organizations and creating fresh opportunities for investors.

Phase 1: Systems of Record emerged as foundational solutions for organizing critical business data. Think of early construction project management tools or legacy healthcare record systems. These platforms served as digital filing cabinets—essential for documentation but requiring manual data entry and offering limited actionable insights. While valuable for compliance, they often created siloed information that couldn't dynamically inform operations.

Phase 2: Systems of Engagement transformed static data into interactive workflows. These solutions, such as real-time restaurant inventory trackers or field service dispatch platforms, enabled collaboration and mobile access. They bridged the gap between data and action, allowing teams to coordinate more effectively. However, they still relied on human judgment for decision-making and execution.

Phase 3: Systems of Work represent our current frontier, where AI agents autonomously execute entire workflows. This is a paradigm shift driven by advances in artificial intelligence and automation. Unlike previous generations of software, which required users to initiate and oversee every step of a process, systems of work empower AI agents to take on entire workflows autonomously. In vertical markets such as construction or logistics, this means platforms that not only track equipment maintenance but also automatically schedule repairs, order parts, and optimize routes based on real-time conditions. These platforms don’t just assist users or store data; they actively perform tasks, make decisions, and deliver outcomes, often with little or no human intervention. Moreover, these systems seamlessly digitize previously offline or siloed data, generating rich, actionable datasets that empower organizations with deeper industry insights.

For an illustrative example of these three phases, we can look at the evolution of customer support.

Shifting from SaaS tools to AI-run services isn’t just a technology upgrade; it’s a game-changer for productivity and business models. Mundane and repetitive tasks get handled 24/7 by tireless AI agents, freeing human team members to focus on high-impact, creative, or complex problems. Organizations can achieve new levels of efficiency, consistency, and scale: AI agents don’t take breaks, don’t make arithmetic errors, and can be replicated instantly. And if you need more capacity, you can spin up more agents via software, without the recruiting, salaries, and management overhead of hiring an equivalent army of people. Just as important, Service-as-Software can deliver more consistent quality and oversight. And whereas humans might vary in their adherence to processes, an AI agent can be updated instantly across the organization when improvements are found. In essence, software services offer the dream of a perfectly trained, always-available team member who never forgets a policy or skips a step.

Why Vertical Industries Are Poised to Benefit

This shift from software-as-tool to software-as-worker is exciting everywhere, but we believe that it will be especially transformative in traditional / antiquated industries, the kinds of verticals that have been “under-digitized” and overlooked by many modern software providers. Fields like construction, logistics, healthcare, and financial services are rife with manual processes, paper-based workflows, and labor-intensive operations. These sectors often operate on slim IT budgets but have huge labor and operations budgets, making them prime candidates for AI-driven services that can be easily integrated to perform tasks.

Vertical markets offer several distinct advantages for this new paradigm:

1. Higher Willingness to Pay for Outcomes

Vertical industries often have specific, measurable pain points that directly impact their bottom line. Unlike horizontal solutions that compete on features, Service-as-a-Software in vertical markets can charge based on tangible outcomes: qualified leads generated, compliance reports completed, or medical records processed, for example. This outcome-based pricing model aligns perfectly with how industry operators think about value creation.

2. Data Moats and Industry Expertise

Successful Service-as-a-Software businesses in vertical markets can build substantial data moats by aggregating industry-specific information. As these platforms process more industry data and tailor their services to the nuanced workflows of their target market, they become increasingly effective, creating a virtuous cycle that’s difficult for competitors to replicate. Importantly, these industries often require highly specific integrations and configurations during implementation, which means that once a solution is in place, switching costs are significantly higher and the product becomes much stickier. This stickiness not only strengthens customer retention but also amplifies the platform’s ability to capture and leverage proprietary data, further reinforcing its competitive advantage in the market.

3. Lower Technology Adoption Barriers

Many traditional industries have been resistant to software adoption due to the complexity, high implementation costs, and challenges associated with change management. Service-as-a-Software eliminates many of these barriers by delivering immediate value without requiring extensive process changes or employee training. Instead of asking users to learn new software, these solutions simply deliver better outcomes through familiar interfaces, which is critical for antiquated markets, which typically have high turnover amongst their employees.

Below are a few real-world examples of pain points in antiquated industries and how Service-as-a-Software solutions could shine:

Construction: Many construction firms still coordinate projects via spreadsheets, whiteboards, and phone calls. Tasks such as scheduling subcontractors, reviewing building plans for code compliance, or processing permits require a significant amount of human hours. An AI “project manager” service could automatically adjust schedules when a delay occurs, or an AI permitting assistant could review plans for code issues and generate permit applications in minutes (startups have already emerged to do exactly this). By acting as a tireless project coordinator, software could eliminate costly delays and rework in construction projects.

Logistics: In freight and supply chain operations, booking shipments and managing exceptions is often a 24/7 human job (think of freight brokers and dispatchers). A Service-as-a-Software freight broker could automatically match loads to carriers, handle communications, and optimize routes using real-time data, effectively behaving like a digital logistics coordinator. This is not far-fetched, digital freight platforms already automate pricing and matching, and adding generative AI could make them even more autonomous.

Healthcare: Healthcare administration is notorious for its bureaucracy, processing insurance claims, scheduling patients, and transcribing medical notes. We now see AI services tackling these tasks: for instance, an AI medical coding assistant can read doctors' notes and assign billing codes, or an AI agent for prior authorizations can call insurance companies to obtain approvals, saving countless hours for clinic staff. Companies have already begun deploying AI agents in healthcare revenue cycle management (RCM) that handle repetitive billing tasks, yielding significant cost savings. In a heavily regulated field like healthcare, these AI services can operate under human oversight to ensure compliance while massively improving throughput.

Financial Services: In lending or insurance, processing an application involves gathering documents, verifying data, assessing risk, and other tasks, traditionally performed by back-office analysts. AI underwriting assistants can automate large portions of this, evaluating documents and even interacting with customers for missing information via natural language. Meanwhile, in wealth management or accounting, we see the beginnings of AI co-pilots that prepare financial plans or tax filings, which a human then reviews. Instead of selling QuickBooks software to a small business and letting them do the bookkeeping, an AI-driven service might be the bookkeeper and tax preparer; you “hire” the software to do the work, not just provide a tool.

Why are these verticals so attractive for Service-as-a-Software? Because many are operating on outdated software (or no software at all) and relying on heavy manual labor, a combination that is ripe for leapfrogging directly to AI automation. Traditional software often failed to penetrate these industries deeply, in part because simply offering a tool wasn’t enough; the internal capacity or willingness to adopt new tech was limited. But offering an AI-powered service that delivers outcomes (e.g., “we will handle your compliance paperwork for you via our software”) is far more compelling. It reduces the need for in-house tech expertise and addresses business owners' key pain points.

Moreover, vertical markets have unique, domain-specific workflows that AI can learn, providing defensibility for startups that develop expertise in a specific industry. At Field, we look to partner with domain experts for this reason: a founder who deeply understands, say, trucking logistics or hospital administration is best positioned to build an AI solution that truly automates those tasks. We specifically look for underserved markets where modern AI can unlock massive value from outdated infrastructure. For example, Wrapbook targets the entertainment production industry. Production payroll was largely manual, think paper time cards and faxed documents, which led to inefficiency and errors. Wrapbook introduced a vertical SaaS solution that not only digitizes the workflow but also acts as the Employer-of-Record, essentially taking on the service of payroll processing for production companies via software. This kind of vertically integrated approach, combining software and service, can be incredibly sticky and valuable in antiquated sectors. We believe that investing in companies that are building systems of work, not just systems of record or engagement, will be the next wave of enterprise value creation.

In summary, the evolution from systems of record to systems of work reflects a broader trend toward automation, intelligence, and outcome-driven software. For us, at Field, that means backing founders who understand how to harness these technologies to transform traditional industries and deliver measurable results for their customers.

The Economic Imperative: Accessing Labor Budgets vs. IT Budgets

One of the most compelling aspects of the Service-as-a-Software model and a key reason why we are particularly excited about this opportunity relates to budget allocation within antiquated industries. When selling traditional B2B software into antiquated markets, you're competing for limited IT or departmental budget dollars, often requiring extensive justification for technology investments that may not show immediate returns or a quick time to value.

In contrast, a Service-as-a-Software company is effectively selling into labor budgets, the money a company would otherwise spend on salaries or outsourcing. These budgets are vastly larger than pure software budgets. As a result, startups in this space can unlock much higher contract values and growth potential by replacing or augmenting labor rather than just offering a tool.

Beyond just market size, selling an AI service often means delivering clear ROI in the language executives care about: outcomes and dollars. Instead of asking a client for a $100K software subscription from their IT budget, you might ask for a $1M contract out of the operations budget because you’ll save them $5M in headcount costs, oftentimes an easier sell. In many cases, Service-as-a-Software companies price their product in line with the value of the work they’re doing (e.g., per transaction processed, per sale closed, per report produced), which directly ties to business outcomes. This outcome-based pricing approach creates strong alignment between the business and their customers’ success. It also tends to scale naturally: if the AI service delivers more work or better results, the customer earns more, and the customer is happy to pay, as it’s tied to the value delivered.

Of course, this doesn’t mean SaaS is going away or that every software product should turn into a service. In many domains, a hybrid approach will remain. Some customers will still want to perform certain functions in-house with their own personnel and tools, especially when they believe they have a competitive advantage or require strict control. We’re likely to see multiple models coexist: human-in-the-loop systems, fully automated services, and traditional software can all thrive side by side. But the takeaway is that for startup founders, Service-as-a-Software opens a new avenue to build massive businesses quickly by capturing value that was previously paid to humans or outsourcing firms. It’s an evolution of SaaS that expands the pie rather than cannibalizing it.

The Pattern: From Tools to Autonomous Services

Across the companies we have evaluated and those within our portfolio, we're seeing consistent patterns emerge:

Key Investment Themes in Service-as-a-Software

Based on our research, several investment themes are emerging in the Service-as-a-Software landscape:

1. Agentic AI Systems

The most promising Service-as-a-Software companies are building systems of AI agents that work collaboratively to handle complex, multi-step workflows. These systems mimic human teams, with specialized agents assigned to specific tasks and continually learning from one another. Unlike single-purpose automation tools, these multi-agent systems can adapt to changing requirements and handle exceptions autonomously.

2. Data-at-Source Positioning

The most defensible Service-as-a-Software companies position themselves at the source of data creation within their target industries. By capturing and acting on information in its raw, unfiltered state, these platforms can initiate actions across downstream systems and build comprehensive workflow orchestration capabilities. This positioning creates significant switching costs and network effects.

3. 24/7 Operational Capabilities

Service-as-a-Software enables entirely new categories of work that were previously impossible due to human limitations. AI agents can operate continuously, providing reliable support and round-the-clock operations in industries like healthcare, security, and customer service. This creates opportunities to deliver services that humans never provided due to time constraints or cost considerations.

Business Model Innovation: From Seats to Outcomes

Traditional SaaS pricing models based on user seats or feature tiers are often misaligned with how Service-as-a-Software creates value. Instead, we're seeing the emergence of outcome-based pricing models that tie costs directly to results achieved.

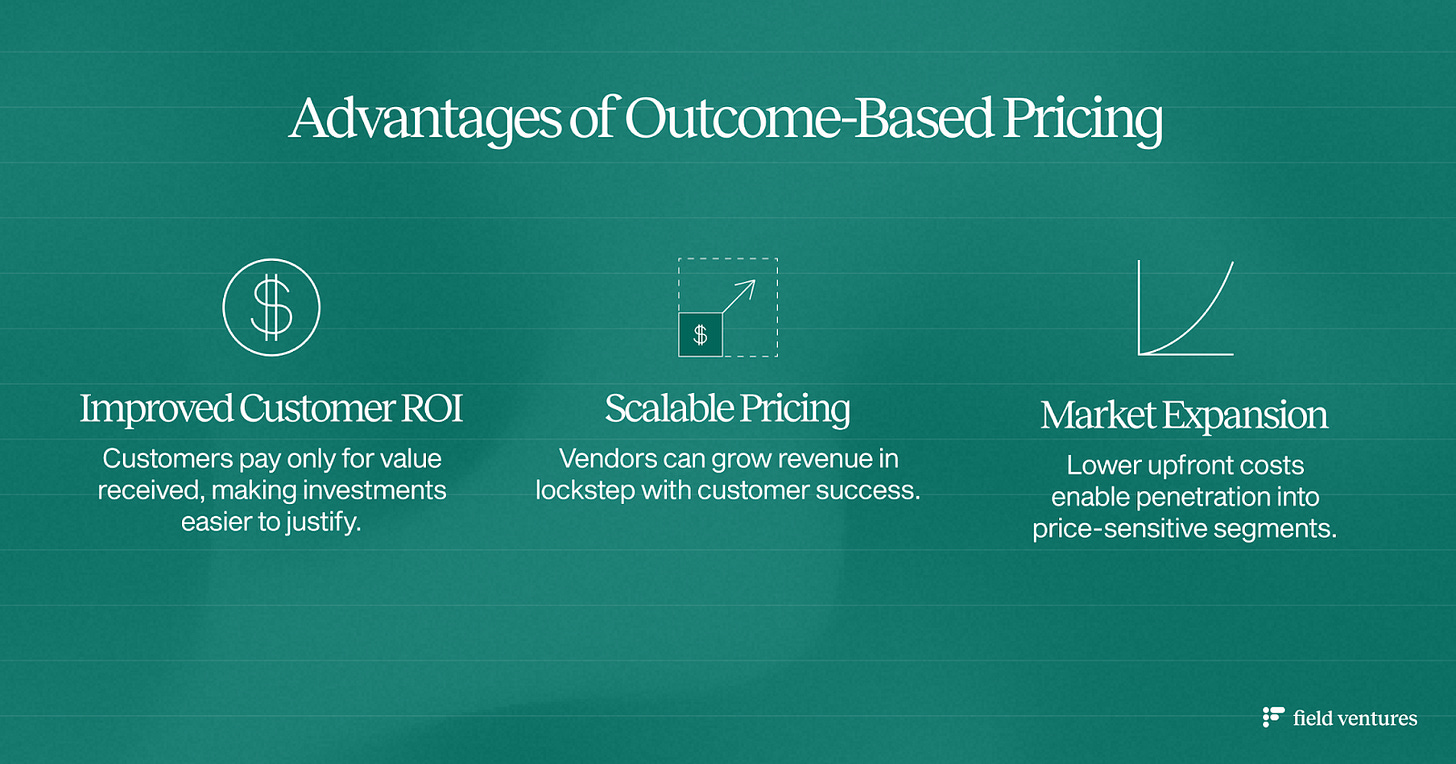

This shift in business model creates several advantages, including the following:

What’s Ahead: Challenges to Navigate

Before we declare the end of human work and fully hand over the reins to our AI coworkers, it’s important to level-set on challenges. Startup founders in the Service-as-a-Software space must navigate several key issues:

1. Technology Readiness & Scope Limits

Despite the hype, today’s AI still has limitations. Generative AI can sometimes produce errors or require a large amount of data to perform effectively. Not every task is yet ripe for full automation. Founders must carefully choose use cases where AI currently excels (or is rapidly improving) and be cautious about over-promising. It’s also important to define the scope of the AI service narrowly at first. Many successful startups are focusing on automating a specific workflow deeply, rather than claiming they’ll be a fully autonomous generalist from the outset. This reduces complexity and allows for better accuracy. There are still workflows and decision points that require human oversight, particularly in high-risk industries such as healthcare and financial services, where sensitive data and critical outcomes demand a cautious approach. Robust human-in-the-loop mechanisms may be necessary to provide validation, manage exceptions, and ensure compliance in these environments. This hybrid approach not only mitigates risk but also builds trust with users and regulators, making it a vital component of any solution operating in high-stakes sectors. This is analogous to managing a human team, except the “training and coaching” involves machine learning and prompt engineering. Field’s view is that domain-expert founders have an edge here: their intimate understanding of the work lets them spot where AI is falling short and quickly iterate to improve it. Nonetheless, technology risks (from model inaccuracies to integration hiccups) will need continual management.

2. Trust and Change Management

Convincing customers (and end-users) to trust an autonomous software service is a non-trivial challenge. Companies may be hesitant to hand over mission-critical tasks to AI without proof of reliability. Early AI solutions will likely need to start with a hybrid approach – for instance, AI generates the output and a human reviews it, or AI handles simpler cases and escalates edge cases to humans. This builds trust over time as the AI demonstrates its capabilities. Moving too fast and losing trust is a quick way to set a business back in a material way or kill the business entirely. Transparency is key: Service-as-Software providers should allow clients to see what the AI is doing, provide audit logs, and make it easy to intervene when needed. Culturally, organizations will also face internal resistance; workers might fear being displaced or feel uneasy working with AI agents. Founders should frame AI services as tools that elevate human workers to more strategic roles (rather than replace them entirely) – at least in the interim. Building customer confidence through pilot projects, reference cases, and small wins is crucial to drive adoption.

3. Competition and Differentiation

As Service-as-a-Software gains momentum, we’ll see incumbents and new entrants vying to automate the same services. There’s a question of who builds the winning AI workers: the SaaS incumbents, the BPO/service firms, or startups? In some cases, incumbents will add more AI automation to their products (as, say, Salesforce is doing with Einstein GPT). In others, entirely new companies will offer a better end-to-end service. Startups should be prepared for competition from both established companies and new entrants. The best defense will be a head start in creating unique datasets and learning. Each task your AI performs teaches your system, creating a data moat. Strong customer relationships and a focus on outcomes (not just technology) also create stickiness. We may also see partnerships (for example, a SaaS firm might partner with an AI service startup to offer their customers a managed service option). Founders need to stay agile and keep an eye on both traditional competitors and other AI players in their niche.

Despite these challenges, the trajectory seems clear: the benefits of AI-driven services are too compelling for businesses to ignore. We are still in early innings, and many companies are just experimenting around the edges with AI copilots and assistants. The transformation of core workflows will take time, perhaps years, and involve plenty of trial and error. But the momentum is there. Those who start adapting to Service-as-a-Software now (with the appropriate safeguards and phased approach) will be ahead of the curve when the technology and market readiness hit full stride.

Investment Implications for Field Ventures

As early-stage investors focused on vertical markets, the Service-as-a-Software revolution aligns perfectly with our investment thesis of backing domain experts who understand industry-specific challenges and can apply innovative technology solutions.

When evaluating founders building within a Service as a Software approach, we seek founders who have the following traits:

Conclusion: A New Era of Work

The rise of Service-as-a-Software signals a new era where the lines between software, services, and labor are blurring. Software is no longer confined to being a tool in the hands of employees; it can be the employee. This shift will undoubtedly reshape business strategies, IT budgets, and career paths in the years and decades to come. It holds the promise of unparalleled efficiency and scalability, as well as the challenge of ensuring that humans and AI work together in harmony and trust. As with any technological revolution, there will be success stories and cautionary tales, as well as wild optimism and justified skepticism.

For startup founders and operators, the takeaway is this: the opportunities at this intersection of AI and traditional services are enormous. By delivering outcomes (not just software) and by targeting the huge pools of spend on legacy labor, you can build category-defining companies while genuinely helping industries evolve. But it requires empathy for the customer’s workflow, respect for the complexity of real-world operations, and a willingness to tackle hard problems with both AI and elbow grease. We believe that the most successful companies will be those that start with a deep understanding of their industry, embrace AI-native approaches, and relentlessly focus on delivering measurable outcomes for their customers. By focusing on outcome-based solutions that tap into labor budgets rather than constrained IT budgets, these businesses can achieve rapid growth, massive revenue, and sustainable competitive advantages.

For entrepreneurs building in this space, the opportunity has never been greater. For investors willing to back domain experts with transformative visions, the potential returns could dwarf even the most successful software investments of the past two decades. If you are building along this theme, please reach out!